What Is Price Elasticity of Demand?

Price elasticity of demand is a term used to describe the relationship between the change in the price of a product and the change in its demanded quantity. In the majority of cases, when the price of an item rises, its quantity demand falls. However, it is not true for every product or service.

To give an example, many customers are willing to pay a premium price for an item manufactured by a luxury brand, in spite of the abundance of cheaper alternatives. In other words, there are certain pricing and non-pricing factors that make a customer pay more than it is necessary. All of these factors come together to form a price elasticity of demand.

The ability to accurately calculate price elasticity is crucial. It can help you maximize your revenue and keep customer loyalty high at the same time.

In the article below, you will read about price elasticity of demand and all the ways in which it can help you take your business to the next level. To begin with, you will learn about the types of price elasticity of demand and see how it can be calculated. Following that, you will familiarize yourself with the different factors that can influence price elasticity, as well as get to see how it can be dealt with using automation software.

What Are the Types of Price Elasticity of Demand?

The value of price elasticity of demand is different depending on product type.

To create a reasonable pricing policy, you should divide your inventory into groups of items according to their price elasticity of demand. Doing so is vital for an effective portfolio management. It can help you lower the risk of sales cannibalization and boost customer lifetime values.

There are quite a few ways of classifying price elasticity. According to an article published by Harvard Business Review, the most balanced approach is based on dividing price elasticity into five different zones.

Perfectly Elastic

If an item is perfectly elastic, the demand for it will drop to zero if its price ever rises. It is a type of price elasticity that is quite uncommon in practice, as consumers make buying decisions based on a number factors, not just price. The said factors could include product quality, delivery time, and brand loyalty.

EXAMPLE – Store A sells apples for $1.50 per half a kilogram. The store invests in better equipment. Later on, it starts dealing with financial issues. Its owners decide to offset the cost of the equipment by raising the price of apples to $2.20 per half a kilogram. Store B, which is not facing any financial issues, continues to sell similar apples for $1.50 per half a kilogram.

Since the apples sold by Store B are very similar to the apples at Store A, customers have no reason to buy Store A’s more expensive apples. As a result, the demand for Store A’s apples drops to zero. To remain competitive, Store A has to find a way to lower the price of apples back to $1.50.

As mentioned above, such a model is rare in practice due to the variety of factors behind each customer’s buying decisions. To illustrate, lifelong customers of Store A might keep on purchasing their apples in spite of an increase in price.

Perfectly Inelastic

Perfectly inelastic demand means that there is no proportional relationship between changes in price and demand. It indicates that consumers would continue to buy a good even if its price were to increase.

Such a model is applicable to various commodities and essentials like tap water and medication. In such cases, customers have few to no alternatives. As a result, the demand would remain the same in spite of an increased price.

EXAMPLE – A city has just one provider of electricity. That provider sells their services for $1,300 per year, but they decide to raise their price to $1,400 per year. Due to the fact that local homeowners cannot get their electricity from any other provider, the demand remains the same.

Just like with perfect elasticity, such a price model is rather rare. In the majority of cases, even with essentials like electricity, customers have different options when it comes to providers or sellers.

Unit Elastic

Unit elastic demand describes a situation in which any change in the price of an item or a service causes an equally proportional change in its demanded quantity. To put it another way, unit elastic demand comes with an implication that a percentage change in demanded quantity of something is the same as the percentage change in its price.

EXAMPLE – A store that carries office supplies sells a certain kind of pencil for $1.50 apiece. 1,100 such pencils are sold every month, which results in a monthly profit of $1,650. The owner thinks that the store could sell many more pencils if the price of a single pencil was lowered. To sell more pencils and make a profit of at least $1,650 per month, the owner has to calculate the unit elastic demand.

The owner decides to sell the pencils at $1.40 apiece, which is a 6.67% decrease in price. That decrease should cause the same increase in sales, which should be around 1,173.

Relatively Elastic

An item or service is relatively elastic if the percentage change in demand is greater than the percentage change in price. In such a scenario, a small change in price can cause significant changes in demand.

It is relatively common when it comes to competitive luxury markets, such as electronics and designer clothing, where even a small decrease in price can make a customer perceive something as more affordable or a sale that should be taken advantage of.

EXAMPLE – A popular brand prices its new smart speaker at $2,000, and sells 2,000 units per month. The brand in question decides to decrease the price of the smart speaker to $1,600, which is a 20% change. As a result, the brand ends up selling 2,500 units per month, which is a 25% change. 25 is greater than 20, which means that the demand for the smart speaker is relatively elastic.

Relatively Inelastic

Relatively inelastic demand occurs when the percentage change in price is bigger than the percentage change in demand. Necessities tend to be relatively inelastic, as customers have few or no alternatives to choose from in case of a price increase.

EXAMPLE – A company sells a subscription-based graphics editor for $100 per year and has 50,000 subscribers. The said company decides to raise the price of the graphics editor to $130 per year, which is a 30% price change. After that, the company has 55,000 subscribers, which is a 10% change. Since the 30% change in price is bigger than the 10% change in demand, it can be concluded that the graphics editor is a relatively inelastic product.

It is worth noting that the price elasticity classification presented above will not fit every retailer’s portfolio. It might need to be adjusted depending on your geographical region and the industry that you work in.

Examples of Price Elasticity

Inelastic Products

- iPhones, MacBooks. Apple is an incredibly strong brand. For that reason, many customers are willing to pay a premium price for an Apple product. If the price of an iPhone or a MacBook rises, a large number of customers will buy it anyway.

- Diamonds. Diamonds are bought infrequently and are the ultimate luxury item with few alternatives. A customer could buy another precious gem, but it probably would not have the same allure as a diamond. A change in price is unlikely to affect demand very much.

- Public transport tickets. Thousands of people rely on the public transport system to get to school or work. In a big city where alternatives for commuting are limited, an increase in the price of fares is unlikely to cause a significant change in customer demand.

- Tap water. If the price of tap water were to increase, householders would keep on paying for it. It is a necessity with no alternatives, and an increased price is unlikely to affect customer demand.

- Salt. It is a good with no substitutes. In addition, customers tend to buy it rather infrequently. If the price of salt were to increase, it would be unlikely to have a noteworthy impact on quantity demanded.

Elastic Products

- Bread. Bread is a product with a high price elasticity. If the price of a particular type of bread were to rise, consumers would quickly find an alternative.

- Chocolate bars. If the price of a specific type of chocolate bar increases, customers will switch to its cheaper alternative.

- Canned soup. There are quite a few different types of canned soup available on the market. If the price of one of the said types were to increase, a typical consumer would switch to a less expensive variety.

- Soft drinks. Soft drinks are not a necessity. A significant increase in price would cause people to look for cheaper alternatives or stop buying soft drinks altogether. On the flip side, a big decrease in price would attract a large number of buyers.

- Cars. There are many models of cars that one could possibly buy, as well as a wide range of brands selling cars. If one brand were to increase the prices of its cars, consumers would look for a similar car manufactured by a different, cheaper brand.

Price Elasticity Formula

In general, the bigger the increase in the price of a product, the fewer customers will be willing to buy it. In such a scenario, the price elasticity of demand will be negative.

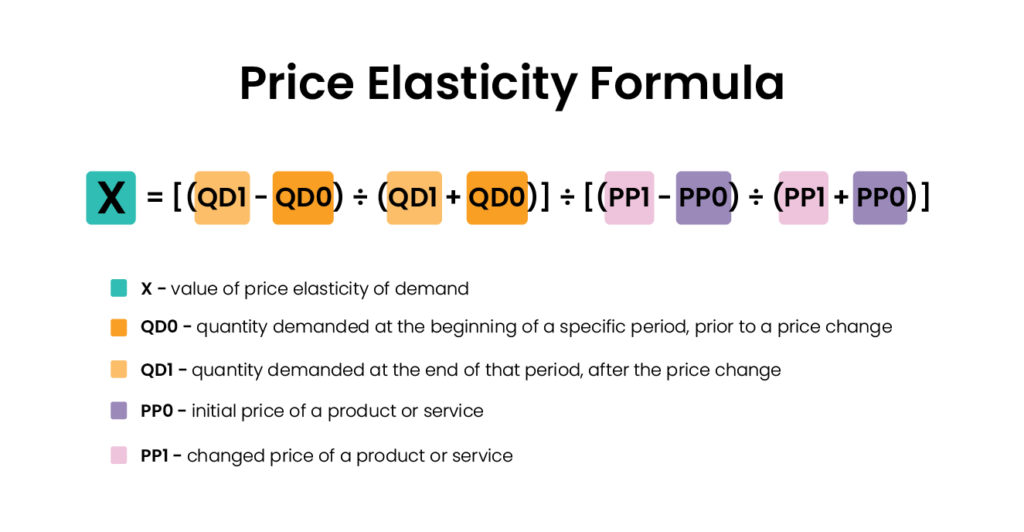

On the other hand, a positive price elasticity value implies that an increase in a product’s price will result in an increased product demand. Such a situation is extremely rare, but it does happen in the luxury goods market. The formula used to calculate price elasticity goes as follows:

The final value of price elasticity will always be negative, as it is meant to measure the opposite relationship between quantity demanded and price. When the value of price elasticity is less than 1, it will result in an inelastic demand. A value that is greater than or equal to 1 signals an elastic demand.

Price Elasticity Curve

Presenting the results of your price elasticity formula on a graph can be quite helpful. It will make it easier for you to visualize the elasticity of demand of different products.

Such a graph is also known as the price elasticity of demand curve. Examining the shape and the slope of the curve can tell you how the elasticity of price for a given product will change under different market conditions and over time. As a result, you can use that curve as a tool to make better decisions regarding product demand and price.

How Do Companies Use It?

Price elasticity is an important metric for marketing managers. It is key to creating an offer that has sustainable and unique value for your customer.

If your product is highly elastic, it is a sign that a customer perceives it as a commodity. A marketer will want to move that product from highly elastic to relatively inelastic through marketing initiatives.

If the said initiatives increase your target customer’s desire to buy it regardless of its price, your company’s standing will become better than the standing of your competitors.

Aside from that, monitoring a product’s price elasticity can help you stay on top of the latest market trends. If the income of an average consumer goes down or if your competitor starts selling attractive substitutes, the price elasticity of your product will rise, prompting you to take action.

Other Common Uses for the Elasticity of Demand Formula

Potential Total Revenue

Calculating price elasticity of demand can help you predict how much revenue a given service or product will bring in under specific market circumstances. You can use that knowledge to make better decisions regarding product prices.

Price Differentiation

Price elasticity could help you determine whether it would be beneficial for you to charge varying amounts under different circumstances. For instance, imagine that you are offering a subscription-based service. You could use the price elasticity of demand formula to calculate if it would be profitable to opt for a tiered subscription model with a few different price points.

Taxation

Elasticity of demand can be helpful if you want to know whether you should accomodate for any additional taxes when setting prices for your products. For example, goods like cigarettes or alcohol are often highly taxed, and you might want to incorporate that cost in your prices.

Want to get set up with competitor monitoring, price tracking and even more?

Book a free demo to monitor any e-commerce competitor pricing and get instant info of important price movements and more!

What Are Some of the Common Mistakes Managers Make With Price Elasticity?

Quite a few managers think they know how their target customer will respond to just about any price change. But rarely do managers test extreme price changes. Instead, they tend to have a small sample of customer responses to more specific aleterations, such as increasing or lowering the price by five to twenty per cent.

A more extreme price change might elicit a completely unexpected reaction. You could try to predict what that response might be using survey responses. However, it may not be an entirely accurate representation of what a customer will actually do when out shopping.

Instead, it is better to do an in-market split test, with your product at its new price point and at a different price point. In a digital context, you could put an item or a service up for twenty dollars, two days later change its price to four dollars, and then sit back and analyze the resulting customer response. Data obtained in such a way is guaranteed to be much more accurate than a survey.

On top of that, it is important that you try to understand customer behavior. You will not be able to get much information out of a split test, let alone predict how a customer will react to a future price change, if you do not try to grasp why they are acting the way they are. Therefore, you should supplement quantitative testing with qualitative research, such as face-to-face interviews, participatory and non-participatory observations, and focus groups.

What Determines Price Elasticity?

Bread and canned soup are more elastic than salt and tap water. What determinants make the demand for those two particular things more elastic?

- Necessities. Giving up buying particular things might not be a viable option. To give an example, if you drive a car and need it to get to work every morning, reducing your gasoline consumption might be difficult. As a result, gasoline can be classified as an inelastic good.

- Product lifecycle. A product that has just entered the market is likely to be inelastic. A new arrival will have very few, if any alternatives to compete with. On the other hand, an item that has been on the market for years will be elastic, as it will have plenty of substitutes.

- Buying behavior. Some customers might be ready to buy a specific thing at almost any price. For instance, if someone is addicted to cigarettes, an increase in price would be unlikely to discourage them from buying another pack.

- Alternatives. The larger the number of alternatives for a product, the more elastic demand will be. If the price of bread of one brand rises, the demand for bread of other brands will grow.

Factors That Determine the Size of Price Elasticity of Demand

A wide range of factors can have an impact on price elasticity of demand. According to a study published in the Australasian Marketing Journal, brand perception and promotional conditions represent the most important factors that determine a product’s price elasticity.

Based on the results of that study and numerous other issue-related studies, one can outline the following implications for the management of price elasticity of demand:

- Price elasticity of demand varies between groups of consumers. For instance, it could be much higher in a group of returning customers who are loyal to a given brand.

- Mass-produced goods are highly elastic. At the same time, unique, luxury goods sold at a premium price tends to be very inelastic.

- An extreme increase in price that exceeds ten per cent might ruin an item’s elasticity of demand. For that reason, business owners stick to single-digit price increases. If the price increases by ten per cent, a potential customer is likely to get discouraged and buy less.

- Price elasticity is dependant on whether a specific good is regarded as a commodity or not. The quality of commodities, such as dish soap, tends to be roughly the same for every brand. Because of that, commodities are highly elastic. If the price of dish soap of one brand were to increase, consumers would buy its less expensive substitute or switch to a brand that is better promoted.

- To maintain an optimal level of demand, business owners have to consider the brand strength of their competitors. If you want your price to be competitive, you should calculate it in relation to your biggest competitors, especially the market leader.

- It is not the price that matters, but how it compares to the prices set by the market leader. If the cost of an item or a service is the same or higher than the cost offered by the market leader, its price elasticity will get higher as well.

The list outlined above is not comprehensive. Still, it might help you understand the complexity of non-pricing and pricing factors that influence elasticity of demand. The main point is that price elasticity of demand cannot be estimated accurately when only the basic factors are taken into consideration.

Automating Price Management

Basic formulas that one can use to calculate price elasticity are not that complicated. However, if you sell hundreds or even thousands of different products, calculating it by hand might become a big problem.

Luckily, advanced technological solutions, such as price management software from Brandly360, are capable of processing hundreds of data points with ease. Aside from price elasticity, such software can analyze a wide range of non-pricing and pricing factors. As a result, you get to determine the optimal price for a given product or service in a matter of seconds.

Manager with experience in leading team of software developers and testers during implementation of internal and external IT projects. Ceo of Brandly360.com.